Inflation in Canada, as measured by the change in the consumer price index (CPI), rose 2.9% on an annual basis in March from 2.8% in February, Statistics Canada reported Tuesday. The reading came in above market expectations. On a month-on-month basis, the CPI gained 0.6%.

The annual core CPI, which excludes volatile food and energy prices, rose 2.0% over the same period.

From Statistics Canada: “Shelter prices continued to exert upward pressure in March, with the mortgage interest rate and rent indices contributing the largest year-over-year gains of all commodities. CPI. In addition, “Services prices (+4.5%) continued to rise in March compared to February (+4.2%), driven by air transport and rents, outpacing the decline in goods price growth (+1.2%) compared to February (+1.1%). “

Market reaction

The Canadian dollar weakened further and hit a fresh annual high above 1.3800 amid the release of USD/CAD and the greenback’s modest gains so far.

Canadian Dollar Frequently Asked Questions

Key factors driving the Canadian dollar (CAD) are the level of interest rates determined by the Bank of Canada (BoC), the price of oil, Canada’s largest export, the health of its economy, inflation and the trade balance. The difference between the value of Canada’s exports and its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – risk-on CAD-positive. As its largest trading partner, the health of the US economy is also a key factor affecting the Canadian dollar.

The Bank of Canada (BoC) has significant influence over the Canadian dollar by setting the level of interest rates at which banks can lend to each other. This affects the level of interest rates for everyone. The BoC’s main objective is to maintain inflation at 1-3% by raising or lowering interest rates. Relatively high interest rates are positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, the former CAD-negative and the latter CAD-positive.

A key factor affecting the value of the Canadian dollar is the price of oil. Petroleum is Canada’s largest export, so the price of oil has an immediate impact on the value of the CAD. Generally, if the price of oil rises the CAD will also rise, increasing the overall demand for the currency. The opposite is the case if the price of oil falls. Higher oil prices also increase the likelihood of a positive trade balance, which also supports the CAD.

Inflation has always been traditionally thought of as a negative factor for a currency because it reduces the value of money, in contrast to the relaxation of cross-border capital controls in modern times. High inflation leads central banks to raise interest rates, which attracts more capital flows from global investors looking for a profitable place to put their money. This increases demand for the local currency, in Canada’s case the Canadian dollar.

Macroeconomic data releases gauge the health of the economy and affect the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer sentiment surveys can all influence CAD direction. A strong economy is good for the Canadian dollar. Not only would this attract more foreign investment, but it could encourage the Bank of Canada to keep interest rates low, leading to a stronger currency. If the economic data is weak, the CAD is likely to fall.

The section below was published as a preview of Canadian inflation data at 08:00 GMT.

- The Canadian Consumer Price Index gathers some upside traction in March.

- The BoC considers the inflation outlook to be balanced.

- The Canadian dollar navigates to a five-month low against the US dollar.

Canada will release the latest inflation figures on Tuesday, with Statistics Canada releasing the Consumer Price Index (CPI) for March. Estimates point to a 3.1% year-on-year increase in the headline figure, accelerating from February’s 2.8% increase. Estimates for the month call for a 0.7% rise in the index compared to the previous month’s reading of 0.3%.

Along with the CPI data, the Bank of Canada (BoC) will unveil its core consumer price index measure, which leaves out volatile components such as food and energy costs. February’s BoC core CPI showed a 0.1% month-on-month increase and a 2.1% year-on-year increase.

These figures will be closely watched because of their potential to influence the direction of the Canadian dollar (CAD) in the near term and shape views on the Bank of Canada’s monetary policy. As for the Canadian Dollar (CAD), it has shown weakness against the US Dollar (USD) in recent sessions and is currently near a five-month low above the 1.3700 yardstick.

What to Expect from Canada’s Inflation Rate?

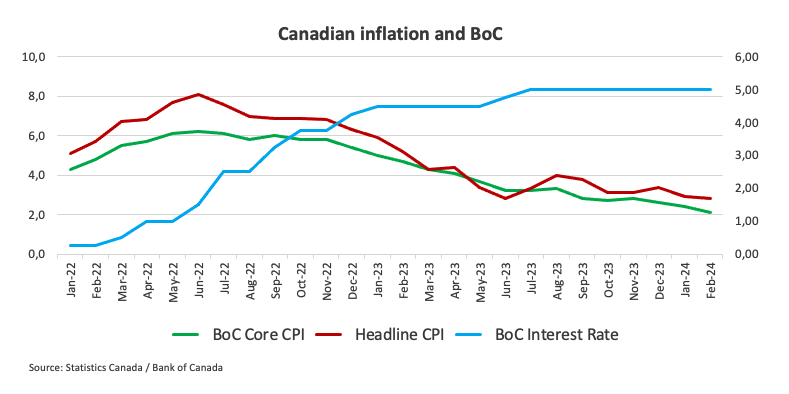

Analysts expect price pressures across Canada to stick around in March. In fact, analysts expect inflation, measured by annual changes in the consumer price index, to accelerate to 3.1% on an annual basis from its previous reading of 2.8%, mirroring patterns observed in many of Canada’s G10 counterparts, particularly the US. From August’s 4% inflation rate, price increases have generally trended downwards, except for a rebound in the last month of last year. Overall, inflation measures have exceeded the Bank of Canada’s 2% target.

If the upcoming data confirms the expected prints, investors may consider the central bank to maintain its current restrictive stance for longer than previously expected. However, monetary conditions seem unlikely to tighten further, according to statements by bank officials.

Such a scenario would require a sudden and sustained revival of price pressures and a rapid increase in consumer demand, both of which appear unlikely in the foreseeable future.

In his press conference after the latest BoC meeting, Governor Tiff Macklem noted that gas prices tend to fluctuate, so they are paying close attention to core inflation. Macklem said he had not seen inflationary effects directly imported from the US, but the bank had not yet had a chance to thoroughly examine the latest US inflation data. In addition, the BoC stated its intention to monitor whether this downward trend continues and pay particular attention to the evolution of core inflation. The bank said shelter price increases are significantly higher and expects headline inflation to be close to 3% in the first half of 2024, easing to below 2.5% in the second half of 2024 and reaching the 2% target in 2025.

Analysts at TD Securities argued: “We see CPI bouncing back to 3.0% y/y from 0.2pp higher in March, with prices rising 0.7% m/m, partly due to another big increase in the energy component along with a rebound. Food prices and staples followed a muted performance in January/February. Analysts added, “An expected move for headline CPI and a large m/m increase for core measures contradicted the Bank of Canada’s desire for more evidence that recent gains will continue. Although the Bank has the April CPI report for its next policy decision, we do not think July will have enough evidence of a sustained slowdown.

When is Canada CPI data due and how will it affect USD/CAD?

At 12:30 GMT on Tuesday, Canada will release its Consumer Price Index for March. The potential reaction of the Canadian dollar depends on changes in monetary policy expectations by the Bank of Canada. However, barring any significant surprises in either direction, the BoC is unlikely to change its current cautious monetary policy stance in line with the policies of other central banks such as the Federal Reserve (Fed).

USD/CAD started the new trading year with a nice bullish trend, although this uptrend seems to have gained additional momentum from last week, breaking above the 1.3700 mark, an area last traded in mid-November 2023.

According to Pablo Piovano, senior analyst at FX Street, USD/CAD has strong potential to maintain its positive bias as long as it remains above the key 200-day simple moving average (SMA) at 1.3515. Bullish sentiment now faces an immediate hurdle at the round milestone of 1.3800. Conversely, a breach of the 200-day SMA could lead to further losses and a dip to the January 31 low of 1.3358. Beyond this point, the lows of 1.3177 recorded on December 27 remain below the support levels until December 2023.

Pablo emphasized that a significant increase in CAD volatility would require unexpected inflation figures. Lower-expectation CPI bolsters arguments for potential BoC interest rate cuts in the coming months, further boosting USD/CAD. However, the CPI rebound, similar to the trends observed in the US, should provide some support to the Canadian dollar, albeit at a limited level. A higher-than-expected inflation reading will increase pressure on the Bank of Canada to maintain elevated rates for longer, potentially leading to longer challenges for many Canadians struggling with high interest rates, as highlighted by Bank of Canada Governor Macklem in recent weeks. .

Canadian dollar price in the last 7 days

The table below shows the percentage change of the Canadian Dollar (CAD) against the major currencies listed over the past 7 days. The Canadian dollar is weak against the US dollar.

| Dollars | Euro | GBP | CAD | AUD | JPY | NZD | CHF | |

| Dollars | 1.89% | 1.44% | 1.34% | 1.96% | 1.62% | 1.63% | 1.03% | |

| Euro | -1.95% | -0.46% | -0.57% | 0.07% | -0.28% | -0.26% | -0.89% | |

| GBP | -1.47% | 0.46% | -0.11% | 0.52% | 0.18% | 0.19% | -0.42% | |

| CAD | -1.35% | 0.56% | 0.11% | 0.64% | 0.29% | 0.31% | -0.31% | |

| AUD | -2.00% | -0.10% | -0.53% | -0.64% | -0.35% | -0.33% | -0.97% | |

| JPY | -1.65% | 0.27% | -0.18% | -0.30% | 0.33% | 0.02% | -0.60% | |

| NZD | -1.68% | 0.25% | -0.21% | -0.31% | 0.33% | -0.03% | -0.64% | |

| CHF | -1.06% | 0.87% | 0.40% | 0.29% | 0.94% | 0.58% | 0.61% |

A heat map shows the percentage changes of major currencies against each other. The base currency is selected from the left column while the quote currency is selected from the top row. For example, if you select the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box represents EUR (base)/JPY (quote).

#Canadian #CPI #rose #expected #March